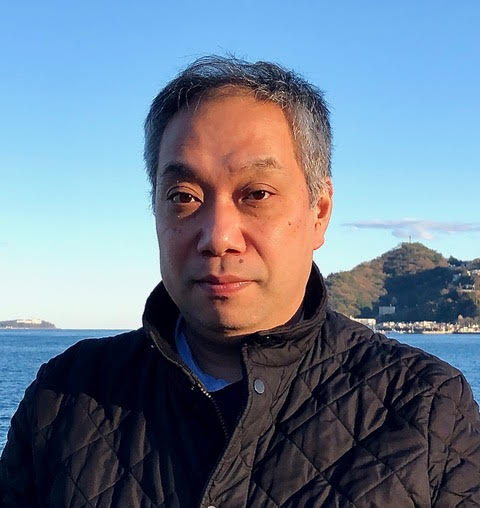

Hiroyuki Nakata

Hiroyuki Nakata

Professor, Development Financial Economics

Keywords: Microeconomic Theory, Financial Economics

Lab webpage

Degree

Current research topics

-

The roles of finance and insurance under diverse expectations

-

Welfare measures under diverse expectations

Selected publications

-

“Are macroeconomic indices fool’s gold?” (with Maurizio Motolese), Journal of Economic Behavior and Organization, 217, 240-260, (2024).

-

“Adverse selection and moral hazard in corporate insurance markets: Evidence from the 2011 Thailand floods,” (with Daisuke Adachi, Yasuyuki Sawada and Kunio Sekiguchi), Journal of Economic Behavior and Organization, 205, 376-386, (2023).

-

“Countering public opposition to immigration: The impact of information campaigns,” (with Giovanni Facchini and Yotam Margalit), European Economic Review, 141, 103959, (2022).

-

“Self-production and risk sharing against disasters: Evidence from a developing country,” (with Yasuyuki Sawada and Tomoaki Kotera), World Development, 94, 27 – 37, (2017).

-

“Welfare effects of short-sale constraints under heterogeneous beliefs,” Economic Theory, 53, 283 – 314, (2013).

Research

The financial system provides households and firms with the means to transfer and share risk and to allocate resources over time, leading to poverty reduction and/or economic development. The system, however, tends to be unstable as past financial crises show, affecting the real economy adversely – in particular, the developing countries and the poor. The instability may well have been propagated by diverse expectations. Also, diverse expectations inevitably cause a conflict between the ex ante and ex post evaluations, making welfare measurement a serious challenge. This is a serious problem, since policies that require international cooperation such as poverty reduction or climate change policies typically involve diverse views, and the lack of an accepted welfare measure makes international cooperation very difficult. My research group are therefore mainly studying the following themes both theoretically and empirically: a) The roles of finance and insurance under diverse expectations; b) Welfare measures under diverse expectations.